maryland earned income tax credit 2019

The state EITC reduces the amount of Maryland tax you owe. Introduced and read first time.

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Allowing certain individuals to claim a refund of the credit. 30 1 I the numerator of which is the Maryland adjusted gross income of 31 the individual.

To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following. This alert addresses changes brought by passage of Chapter 40 of the Acts of 2021 concerning Income Tax Child Tax Credit and Expansion of the Earned Income Credit. The state eitc reduces the amount of maryland tax you owe.

Earned Income Tax Credit For 2019. 19 iv The amount of any refunds payable under a refundable county 20 earned income credit operates to reduce the income tax revenue from individuals 21 attributable to the county income tax for that county. Altering the calculation of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim an increased credit.

Introduced and read first time. Reduces the amount of Maryland tax you owe. 30 1 i the numerator of which is the maryland adjusted gross income of 31 the individual.

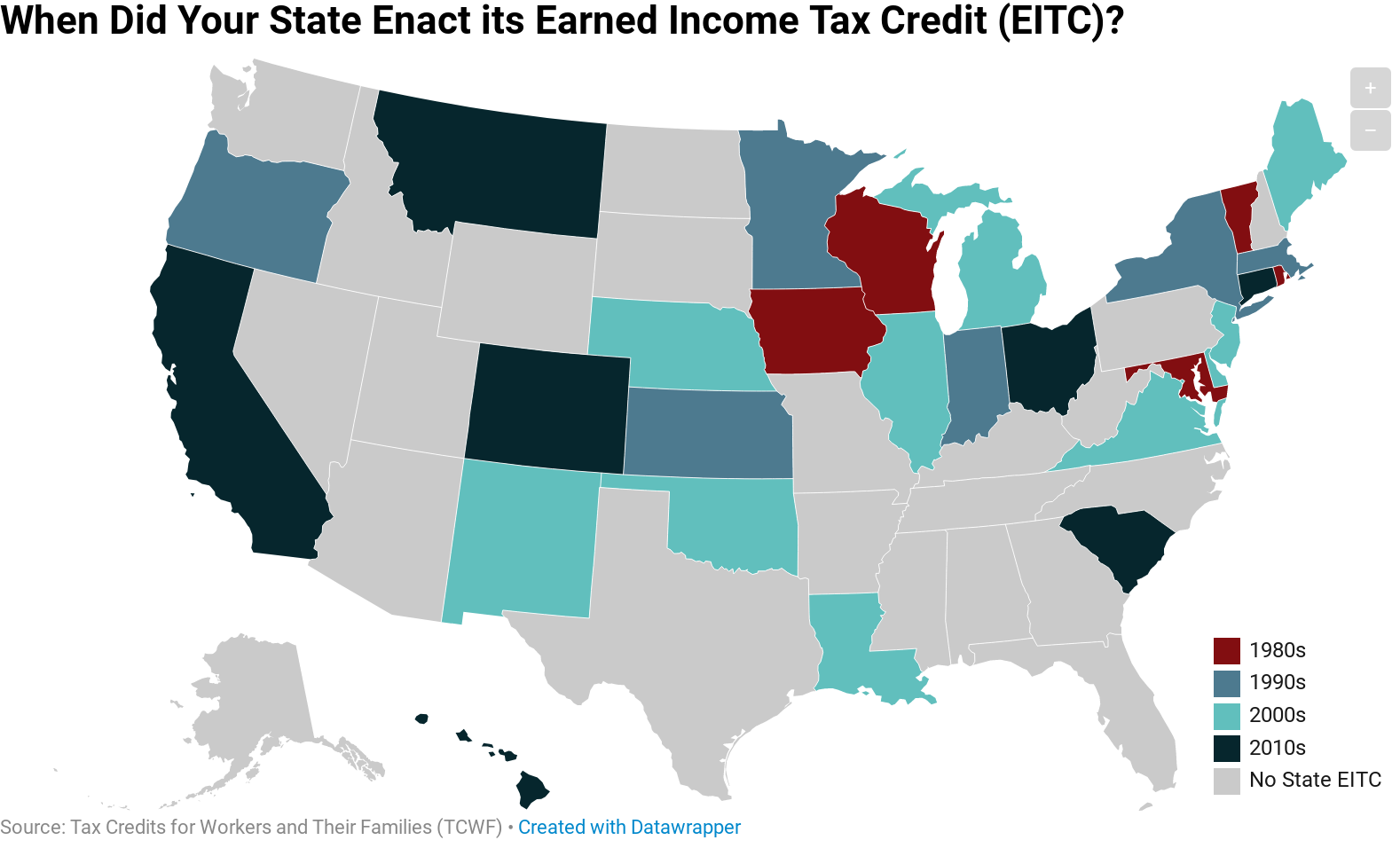

In 1998 Montgomery County Maryland adopted a local earned income tax credit EITC program. Get Your Max Refund Today. Expanding the eligibility of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim the credit.

Allowing certain individuals to claim a refund of the credit. In 2019 86000 Maryland workers paid taxes this way and 60000 of them had incomes low enough that they would have qualified for the tax credit if allowed. Budget and Taxation A BILL ENTITLED 1 AN ACT concerning 2 Earned Income Tax Credit Individuals Without Qualifying Children 3 Eligibility and Refundability 4 FOR the purpose of expanding the eligibility of the Maryland earned income tax credit to.

27 earned income credit allowable for the taxable year under 32 of the Internal Revenue 28 Code that is attributable to Maryland determined by multiplying the federal earned 29 income credit by a fraction. And applying the Act to taxable years beginning after. Applying the Act to taxable years beginning after December 31 2018.

Providing that the amount of the credit that may be claimed by certain individuals is adjusted for inflation each year. With TurboTax Its Fast And Easy To Get Your Taxes Done Right. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following.

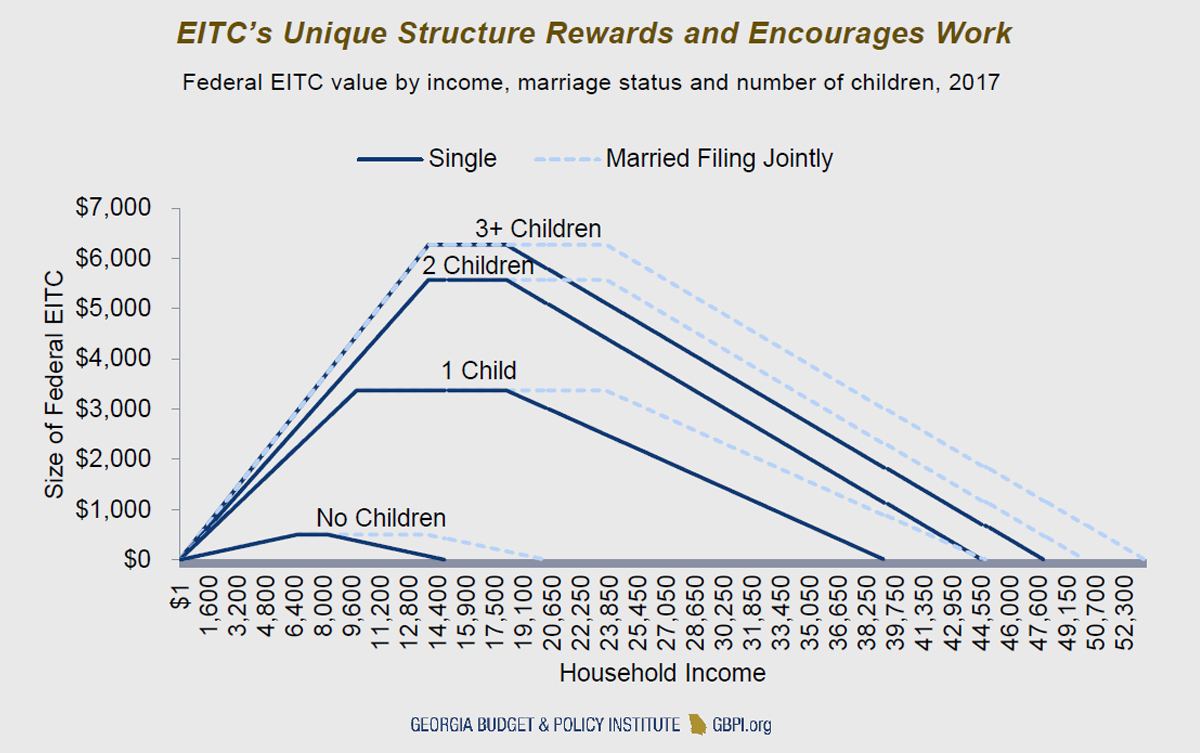

The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Allowable Maryland credit is up to one-half of the federal credit. Expanding the eligibility of the Maryland earned income tax credit to allow certain individuals without qualifying children to claim the credit.

18 income tax for the taxable year. February 4 2019 Assigned to. The allowable Maryland credit is up to one-half of the federal credit.

If you work and have W-2 andor 1099 income at a certain level let the EITC work for you. Even though you can no longer eFile 2019 Tax Returns you can estimate and calculate your 2019 Taxes here. Providing that the amount of the credit that may be claimed by certain individuals is adjusted for inflation each year.

Search for jobs related to Maryland earned income tax credit notice 2019 or hire on the worlds largest freelancing marketplace with 20m jobs. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. The 2019 Tax Year Earned Income Tax Credit or EITC is a refundable tax credit aimed at helping families with low to moderate earned income.

The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years. 50162 55952 married filing jointly with three or more qualifying children 46703 52493 married filing jointly with two qualifying children. Allowable Maryland credit is up to one-half of the federal credit.

I have a client whose domicile is state of md but he has resided and worked in foreign country from 2019. Its free to sign up and bid on jobs. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following.

Allowable Maryland credit is up to one-half of the federal credit. It discusses the additional taxpayers eligible to claim the Maryland Earned Income Credit s and the requirements for claiming the Child Tax Credit. Allowing certain individuals to claim a refund of the credit.

Vital Statistics data covering births in Maryland from 1995 to 2004 to examine whether the local EITC impacted birth weight and the probability of low birth weight in Montgomery County. Most taxpayers who are eligible and file for a federal EITC can receive the Maryland state and local EITC. January 25 2019 Assigned to.

Your employees may be entitled to claim an EITC on their 2019 federal and Maryland resident income tax. The earned income tax credit or. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

The local EITC reduces the amount of county tax you owe. 49194 54884 married filing jointly with three or more qualifying children. Maryland earned income tax credit 2019.

2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. 50162 55952 married filing jointly with three or more qualifying children 46703 52493 married filing jointly with two qualifying children. And applying the Act to taxable years beginning after.

2019 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide electronic or written notice to an employee who may be eligible for the federal and Maryland EITC. The Maryland earned income tax credit EITC will either reduce or. To be eligible for the federal.

Some taxpayers may even qualify for a refundable Maryland EITC. Ways and Means A BILL ENTITLED 1 AN ACT concerning 2 Earned Income Tax Credit Individuals Without Qualifying Children 3 Eligibility and Refundability 4 FOR the purpose of expanding the eligibility of the Maryland earned income tax credit to.

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute

The Differences Between Va Md And Dc Taxation Lipsey Associates

Summary Of Eitc Letters Notices H R Block

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Table 1 From The Earned Income Tax Credit Eitc Percentage Of Total Tax Returns And Credit Amount By State Semantic Scholar

When Did Your State Enact Its Eitc Itep

Filing Maryland State Taxes Things To Know Credit Karma Tax

Solved Can I Claim The Eitc This Year Using The Lookback

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Earned Income Credit H R Block

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Maryland Relief Act What You Need To Know Mvls

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Refundable Credits The Earned Income Tax Credit And The Child Tax Credit Full Report Tax Policy Center

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)